Marshall J. Vest

Forecasting Project Director

University of Arizona

Evidence continues to grow that the U.S. economy bottomed out during the second quarter – likely in June, maybe May. In Arizona, economic measures remain on a downward trend, confirming our expectation that the state will lag behind the rest of the country. In our annual update of long-term projections, we’ve lowered our forecasts for 30 years hence, but we still foresee population nearly doubling.

Gains in the index of leading economic indicators, better numbers for housing, recovering economies of major trading partners, increases in industrial production, higher production schedules by auto makers, large declines in inventories, rising productivity, widening profit margins, and recovery in capital expenditure plans are all pieces of evidence supporting belief that the recession has ended.

Consensus forecasts now call for a sluggish recovery due to still tight credit markets and sluggish consumer spending. Budget restraints by state and local governments and an emptying of the non-residential construction pipeline also will retard growth in the near term. It will probably be 2011 or 2012 before robust growth resumes.

Recent Evidence for Arizona

Aggregate bellwether measures show that Arizona’s economy remains in recession but that a bottom is beginning to form. July nonfarm employment declined at a seasonally adjusted annual rate of 7.7%. Compared to year-earlier readings, those losses are worse than in any other state. But the declines are not as large as six months ago when employment was plunging at nearly a 10% annual rate.

Sales data also are beginning to stabilize. Retail sales, which was declining at a 20% annual rate last winter, was declining at a much more subdued 5.3% rate in June. “Cash for Clunkers” deserves partial credit. Better yet, restaurant and bars sales have bottomed out and actually registered a small 1.5% increase in June.

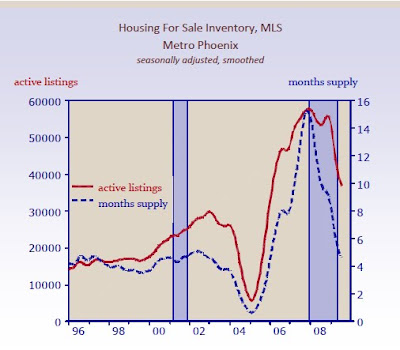

Housing markets also are showing signs of improvement. Although foreclosures remain high, inventories of housing for sale are falling and prices are beginning to stabilize. In July, MLS listings in metro Phoenix fell to 36,000 compared to 58,000 a year-and-a-half ago. With the number of sales now running at a 90,000-plus annual rate, the supply would be exhausted in only 4.5 months. Although a four-to-five month supply is considered “normal,” housing markets are still far from normal. Roughly half of recent sales were foreclosed properties or “short sales,” mortgage financing remains tight — especially for jumbo loans, and migration flows remain depressed (Exhibit 1).

Exhibit 1: Housing Markets Are On the Mend

Although it’s too soon to expect much of a rebound in homebuilding, we could see permit activity pick up from very depressed levels in coming months.

Updating a graphic that we prepared six months ago (Exhibit 2), we find that residential building activity (as measured by building permits) has fallen by 89% from its peak level. That compares to declines of 74% and 71%, respectively, during two earlier severe recessions. Nonfarm employment is down 9.1% so far, compared to a 4.5% peak-to-trough decline in the mid 1970s, and 2.2% in the early 1980s. Inflation-adjusted retail sales fell 10.7% in the 1970s recession and 33.1% in the early-1980s. In the current recession, sales have fallen 27.1% so far.

Need further clarification? Give us a call today…480-889-1424.

Leave a Reply